Marks and Spencer Group (LSE: MKS) shares have been on a downwards slide since the start of the year. However, there’s a case to be made that M&S stock is oversold. Its current share price could present a bargain for the long term, and here’s why.

Marks and Spencer shares its concerns

It’s no secret that shares in the grocery industry have been performing poorly. This has been exacerbated by the current cost-of-living crisis. So today, CEO Stuart Manchin set out the company’s ‘Reshaping for Growth’ plans.

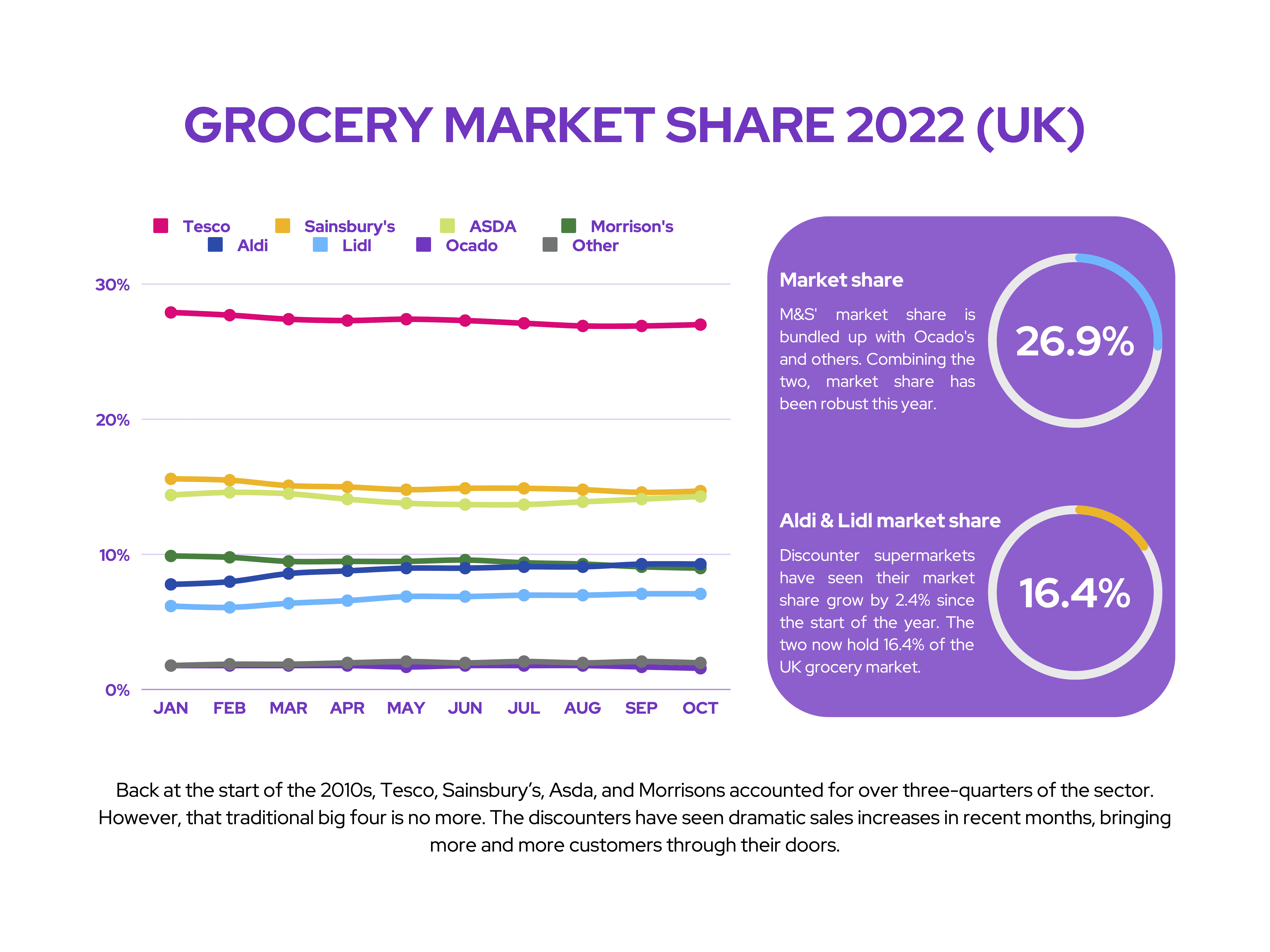

On the call, Manchin mentioned a shift in consumer behaviour, to seek out more value. This can be seen in the grocery market share data, which has seen discount grocers like Aldi and Lidl increase their market share.

Should you invest £1,000 in Marks and Spencer right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Marks and Spencer made the list?

Nonetheless, it’s important to note that M&S’ market share has remained robust at 3.6% throughout the year. This is rather impressive, in my opinion, given the down trading by most consumers during this inflationary period.

The strong performance thus far is most likely due to the Veblen effect. This is a phenomenon that occurs when consumers perceive higher-priced items as being of better quality. M&S’ brand is associated with premium offerings and good value, which has been a valuable selling point.

Tesco‘s latest H1 results offer some insight on this effect as well. CEO Ken Murphy mentioned that consumers have been opting to purchase more of its Tesco Finest items, as people seek better value. Murphy attributed this to changing consumer behaviour as people opt to invite guests over, rather than dine out, given the current inflationary environment. As a result, Tesco has increased its line of premium products by 13%.

Unfashionable outlook

Food aside, M&S has also seen its fashion arm performing well. The division saw healthy volume growth in clothing and home products over the summer. As such, M&S will be doubling down on its kids clothing lines, with plans to launch sportswear in early 2023. Nevertheless, the outlook for clothing is underwhelming.

Latest figures from the BDO’s High Street Sales Tracker showed that September’s retail sales grew at the slowest pace since the pandemic. Fashion sales were only up by a measly 6.7% on an annualised basis (Y/Y). While this may seem like a decent figure, retailers should be expecting a higher figure as this is a period when shoppers usually spend on their autumn and winter wardrobes. Not to mention, increased pressure on its clothing costs from a stronger dollar are expected to trim margins.

That being said, a weaker pound should help encourage more spending from tourists during the Christmas period. This is expected in major cities, where I’m expecting the firm to benefit, given its large portfolio of convenience stores in metropolitan areas, as well as its plans to open more food stores. After all, Tesco reported that its convenience stores experienced a surprising uptick in sales and footfall, growing 6.5% (Y/Y).

Igniting Sparks

What’s really pleased me as an investor is that Marks and Spencer continues to grow its loyalty programme, Sparks. Since being revamped, Sparks has seen an increase in adoption. As a matter of fact, it’s grown its user base from 6m members to 16m in less than two years.

This paves the path for M&S to continue growing its business and market shares in food and fashion. Because of the success of Sparks, the board expects to grow its food market share by approximately 1% in the medium term, while bringing in a healthy 4% margin. The same is also expected for market share gains in clothing, with a 10% margin.

M&S gets to the Gist

Moreover, the retailer has plans to continue modernising its food supply chain when it acquired logistics company, Gist. The acquisition is forecasted to save M&S £50m. This stems from the removal of management fees, better networks, and increased productivity.

Furthermore, the company has other cost savings strategies in place. These include further investments into more energy-efficient refrigeration and lighting, increased automation, and fewer layers of management. Therefore, with lofty ambitions and an effective cost savings plan, I believe Marks and Spencer shares are prime to deliver value to the company’s shareholders.

Remarksable value?

So, will I buy Marks and Spencer shares for my portfolio then? Well, its balance sheet isn’t in the best state as it’s still recovering. Plus, the most recent couple of quarters haven’t presented the best environment for the company to grow. This in itself presents a couple of concerns. The first is energy prices eating into the bottom line. The second is the underperformance of its joint venture with Ocado; the online supermarket reported a less than ideal set of results last month. For that reason, Deutsche Bank lowered its price target for M&S stock to £1.45 from £1.55, despite retaining its ‘hold’ rating.

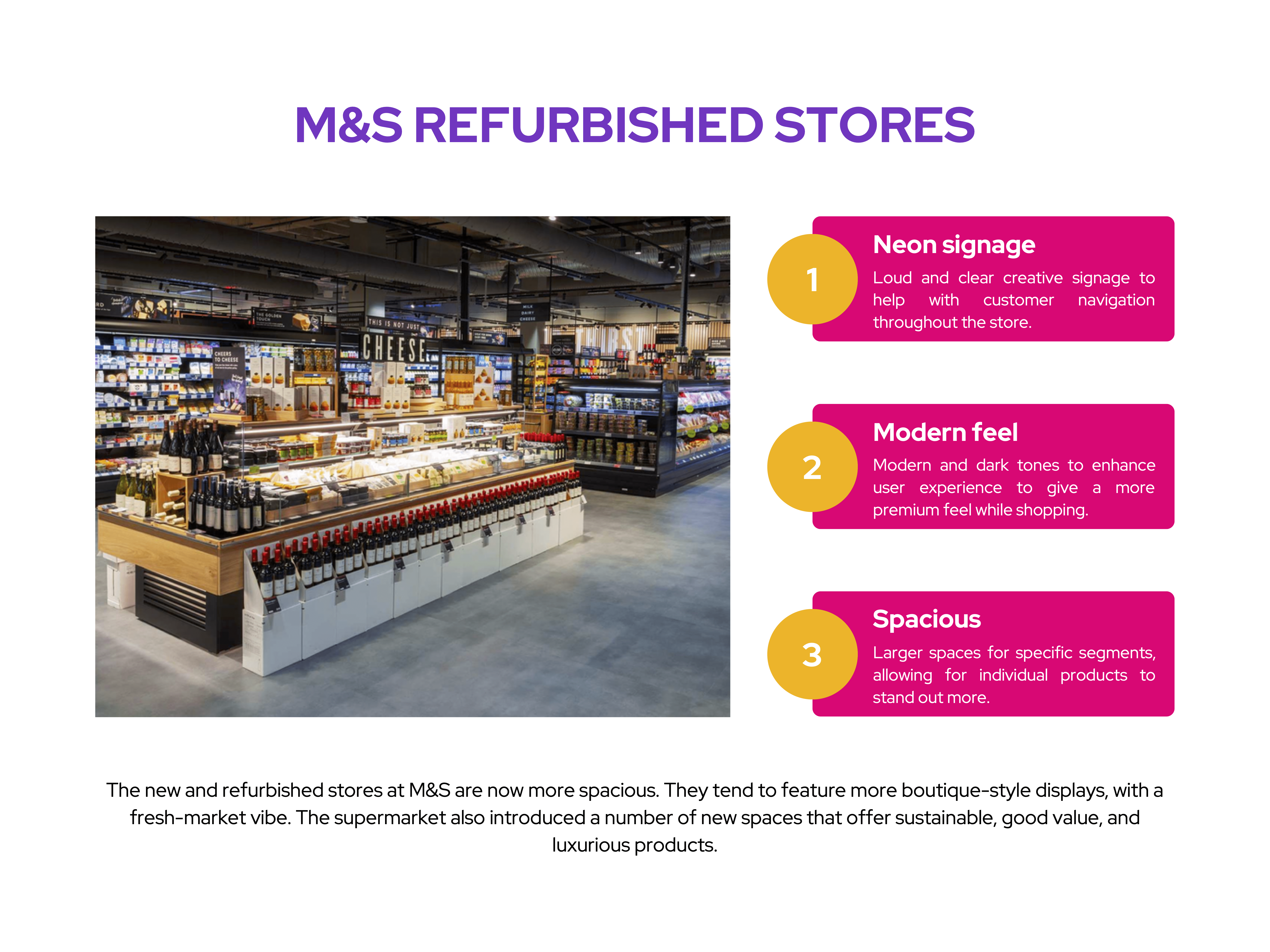

On the flip side, the long-term outlook remains bright, provided that management can meet it. Let’s not forget the number of times M&S has had to revise its growth plans over the years. The company expects its operating profit to double by 2028 and to continue growing its business locally and internationally through providing the best omni-channel experience for customers. It’s definitely a long way to go, but just take one look at its refurbished stores and it’s not difficult to understand why there’s certainly potential.

Currently, the stock has an average analyst rating of ‘hold’, and an average price target of £1.43. This would present a 50% upside to its current share price. The short-term outlook may be volatile as the company faces tremendous cost headwinds , but the long-term potential is one that I can’t pass up on. This is especially the case with a price-to-earnings (P/E) ratio as low as six. This is why I’ll be adding to my current position through pound-cost averaging.